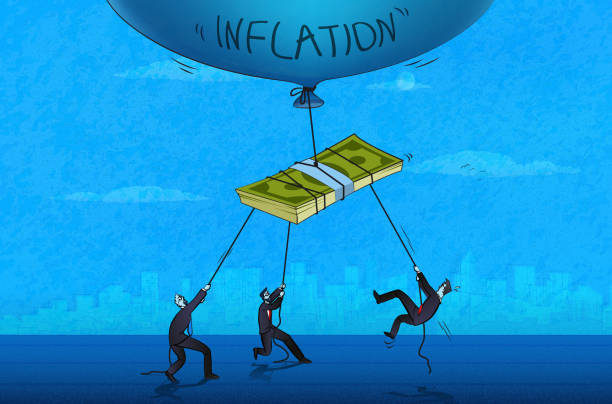

Inflation. There are no indications that it will slow down any time soon, and there is no quick fix. The timing is, therefore, terrible if you have just retired or are about to retire. Nobody has been concerned about inflation for almost 40 years. A whole generation has never even known how inflation might affect their finances. However, the current inflation rates are the highest since 1982.

Families are worst hurt by price hikes in electricity, autos, housing, and food. But it goes further than that.

Even the costs of travel (flights, lodging, and rental cars), TVs, appliances, and furniture have risen to heights that were unthinkable just a year ago. Everyone will be affected by these exorbitant rates. However, pensioners will be more affected than working families.

The “silent killer” of retirement: inflation

When you have a fixed income, spending more on groceries and gasoline means making trade-offs someplace else. And before you realize it, you can be compelled to choose between purchasing necessities like food or medicine.

Many experts are concerned that the current inflation rate may be worse than we think, while some people think a recession could be coming soon.

The 71st Secretary of the Treasury of the United States and economist Larry Summers have expressed their concern that we are already approaching a point when cutting inflation without triggering a recession will be challenging.

The effects on your nest egg are still felt even at modest inflation rates of 2% or 3%.

Marketwatch claims that a 3% inflation rate would gradually reduce your ability to buy things. For instance, if your retirement budget is $5,000 per month, your purchasing power would decrease to $3,720 a month in 10 years. Your purchasing power would be only $2,760 per month after 20 years.

Therefore, even with a mere 3% inflation rate, your purchasing power might be lost in just 20 years.

Think about what recent inflation rates might quickly do to your retirement savings. But set aside the numbers and consider inflation differently. What did your home cost twenty or thirty years ago? It was significantly less expensive than what someone would pay today, right?

What do you believe the value of your home will be in 20 or 30 years? I think it’s safe to say that it would be worth a lot more. The same is true for every purchase you make, including that brand-new La-Z-Boy recliner, groceries, and gas.

Most retirees encounter difficulties in this area. They set a savings target based on current prices rather than projected prices for the next 20 or 30 years. And this can increase the likelihood that you’ll run out of money in retirement.

But not all the news is negative. You can use a few easy tactics to prevent losing purchasing power to inflation. These techniques may help reduce risk while providing a solid hedge against inflation. The sooner you take concrete action, the better off you’ll be in either case. Nobody can afford to ignore inflation when rates are this high.

Contact Information:

Email: [email protected]

Phone: 2129517376

Bio:

M. Dutton and Associates is a full-service financial firm. We have been in business for over 30 years serving our community. Through comprehensive objective driven planning, we provide you with the research, analysis, and available options needed to guide you in implementing a sound plan for your retirement. We are committed to helping you achieve your goals. Visit us at MarvinDutton.com . Tel. 212-951-7376: email: [email protected].

Financial Media & Marketing, LLC,

Financial Media & Marketing, LLC,